Regulators expect timely, accurate disclosures; investors demand transparent ESG performance; customers reward brands that do the right thing and prove it. Yet inside most enterprises, compliance is chaotic, with internal data scattered across finance, supply chain, HR, and operations. Databricks helps break down these silos, unifying enterprise data on a single platform so organizations can generate accurate, auditable, and timely insights, even as global frameworks like CSRD, GRI, SASB, and the EU Taxonomy evolve continuously.

For many organizations, compliance still feels like running on a treadmill that never slows down: months of manual document reviews, spreadsheet gymnastics, fragmented evidence trails, frantic audit preparation, and a lingering fear that something critical was missed. When compliance is treated as a box-checking exercise, it drains resources and delivers little strategic value. With Databricks, enterprises can turn compliance from a reactive burden into a source of confidence and credibility.

It doesn’t have to be this way.

The Databricks AI Compliance Agent: Turning Obligation into Advantage

The Databricks AI Compliance Agent is an autonomous, always-on solution built on the Databricks Data Intelligence Platform. It continuously monitors evolving compliance frameworks, validates disclosures, and benchmarks reports against regional and global standards. Unlike static reporting tools or one-off consulting engagements, the Databricks AI Compliance Agent embeds governance directly into day-to-day operations—transforming compliance from a defensive burden into a driver of credibility and confidence.

With accurate, explainable, and auditable outputs generated entirely within the governed Databricks environment, enterprises can engage regulators, auditors, and investors with clarity—and turn ESG rigor into a Databricks-powered competitive edge.

The Compliance Squeeze: Why Status Quo Breaks

Enterprises face five compounding pressures:

- Regulatory complexity. Dozens of frameworks and interpretive guidance change frequently, and they don’t map 1:1.

- Resource-intensive reviews. Human-only review across hundreds of pages and data sources is slow and error-prone.

- Financial exposure. Penalties, restatements, and remediation costs hit both P&L and reputation.

- Reputational risk. Inconsistent or incomplete reporting erodes stakeholder trust and brand equity.

- Investor scrutiny. Asset managers and lenders expect consistent, comparable, and decision-useful ESG data—backed by evidence.

Traditional approaches struggle because they’re manual, repetitive, reactive, and error-prone. A static dashboard can display metrics, but it rarely tells you whether those metrics satisfy CSRD Articles, align to GRI topic-specific standards, or map cleanly to SASB industry metrics.

This is where Databricks makes the difference, unifying fragmented data, automating validation, and applying AI-driven reasoning to deliver compliant, defensible disclosures at scale.

Introducing the AI Compliance Agent:

The Databricks AI Compliance Agent reimagines ESG compliance as a living, intelligent system built on the Databricks Data Intelligence Platform. It is:

- Autonomous and always-on. Continuously ingests new regulatory guidance into Databricks and compares it with your current disclosures and evidence.

- Context-aware. Understands industry, geography, and materiality to interpret what “good” looks like for your organization using Databricks-native intelligence.

- Prescriptive. Goes beyond flags and gaps to recommend exact next actions, owners, and due dates—all traceable within the Databricks workspace.

- Auditable. Every conclusion is tied to data points, sources, and the specific clause or control it addresses, with lineage recorded in Databricks Unity Catalog.

Operating entirely within your governed Databricks environment ensures data privacy, provenance, and verifiable outputs—empowering enterprises to stay compliant with confidence while turning regulatory rigor into measurable business value.

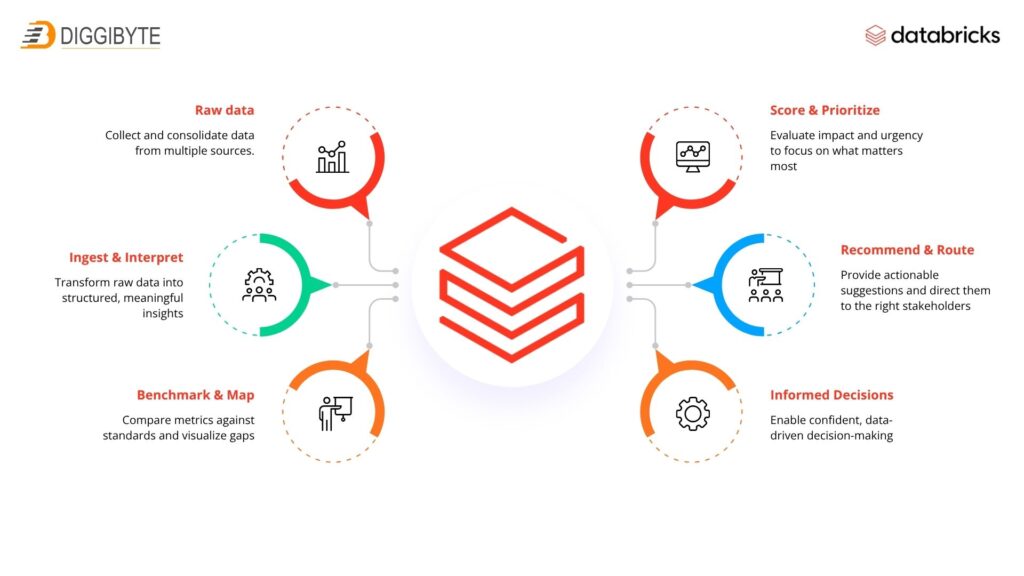

How It Works: From Documents to Decisions

1) Ingest & Interpret

Pull sustainability reports, corporate policies, supplier attestations, emissions data, HR and safety logs, and financial footnotes into the Databricks Lakehouse. The Agent leverages LLM-powered extraction to normalize metrics, structure unstructured data, and cite sources—ensuring every data point is traceable.

2) Benchmark & Map

Cross-reference disclosures against CSRD, GRI, SASB, and EU Taxonomy. The Agent builds a live, dynamic requirements map in Databricks, highlighting what’s fully covered, partially met, or missing entirely.

3) Score & Prioritize

Generate risk-weighted gap analyses by pillar (E/S/G), by topic (e.g., Scope 3, water, waste, DEI), and by jurisdiction. Assign confidence levels and evidence strength, all calculated and stored securely in the Databricks environment.

4) Recommend & Route

Create prescriptive, actionable tasks: e.g., “Add supplier audit evidence for Tier-2 emissions (GRI 305-3); owner: Procurement; due: 10 days.” The Agent integrates seamlessly with issue trackers or workflow tools, ensuring follow-up is automated and auditable.

5) Report & Assure

Produce export-ready, clause-aligned reports for auditors and regulators with line-level citations to source data and controls. Share visual scorecards with executives and investors—all powered and governed by Databricks, so outputs are reliable, auditable, and confidence-inspiring.

Key Features:

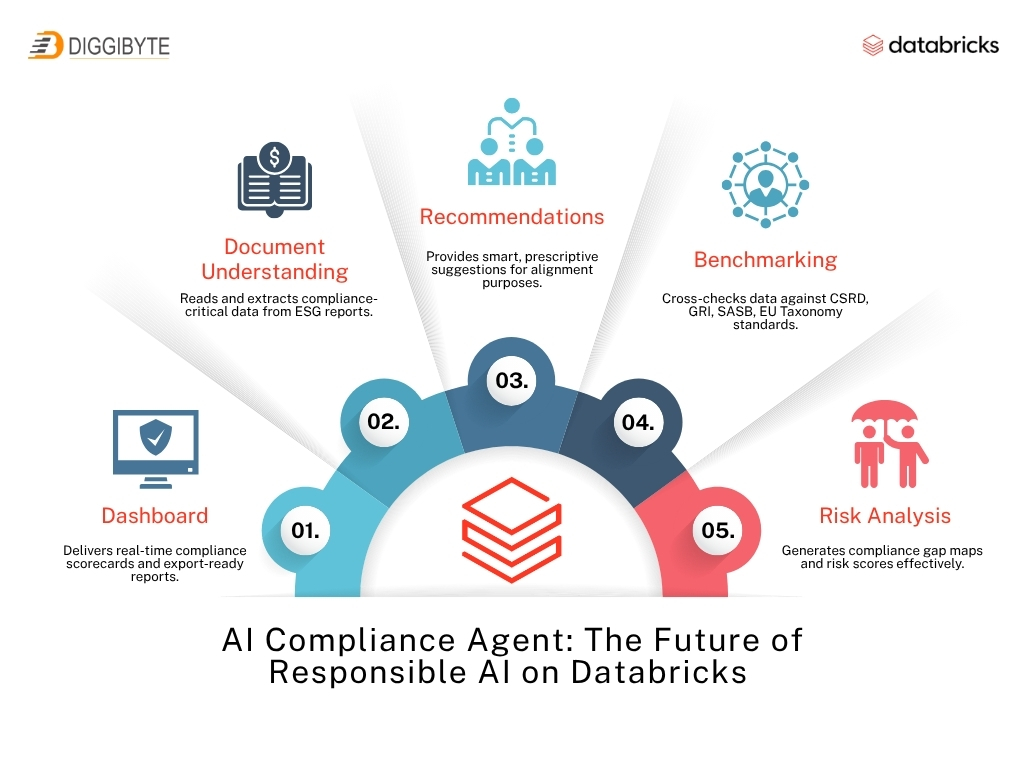

1) Autonomous Document Understanding

- Reads corporate sustainability reports, management commentary, board minutes, supplier codes, and assurance letters—all ingested into the Databricks Lakehouse.

- Extracts compliance-critical metrics (e.g., Scope 1/2/3 emissions, water withdrawal, injury rate, pay equity) and normalizes units and boundaries using Databricks-native AI/LLM extraction.

- Example: Detects that Scope 3 Category 1 excludes private-label suppliers and flags boundary inconsistencies, directly within Databricks for traceability.

2) Regulatory Benchmarking

- Maps disclosures to clause-level requirements across CSRD, GRI, SASB, EU Taxonomy, and local rules using Databricks-powered intelligence.

- Highlights missing disclosures and misaligned definitions (e.g., renewable vs. low-carbon).

- Example: Confirms SASB alignment for your industry but flags EU Taxonomy eligibility/alignments as incomplete for CapEx/OpEx —all visible in Databricks dashboards.

3) Risk & Gap Analysis

- Produces heatmaps and risk scores by dimension and geography within the Databricks Lakehouse, leveraging unified data from ESG, finance, and HR.

- Quantifies exposure: severity × likelihood, informed by peer benchmarks and past audit findings.

- Example: Governance risk spikes due to insufficient board-level ESG oversight minutes in the last two quarters.

4) Smart Recommendations

- Suggests targeted actions with owners, evidence types, and expected impact on risk reduction using Databricks-prescriptive AI workflows.

- Learns from historical audits and your internal control framework to adapt future guidance.

- Example: “Publish methodology for Scope 3 screening; add third-party review to raise assurance level from limited to reasonable.”

5) Compliance Readiness Dashboard

- Real-time Databricks-powered scorecards with drill-downs: by framework, clause, business unit, or country.

- Export-ready regulator packets and investor summaries with cited evidence and lineage tracked in Databricks Unity Catalog.

- Example: Generate a CSRD Article 8 alignment pack with clear taxonomy mapping and eligibility/ alignment calculations.

Business Impact: Compliance as Strategy

Implementing the AI Compliance Agent on Databricks delivers measurable, enterprise-grade outcomes:

- Accelerated reviews: Cut compliance cycles from months to near real-time; publish earlier with confidence.

- Reduced regulatory risk with Databricks governance: Fewer violations, restatements, and penalties through proactive gap closure.

- Enhanced transparency through Databricks auditability: Clause-aligned disclosures with source citations earn investor trust.

- Lower cost-to-comply via Databricks automation: Automate repetitive checks; focus scarce experts on judgment and assurance.

- ESG differentiation at scale with Databricks AI: Demonstrate rigor and credibility to customers, partners, and rating agencies.

- Future-proof operations on Databricks: As frameworks evolve, the Agent updates mappings and recommendations automatically.

Operational KPIs you can track with Databricks:

- % of disclosures clause-aligned with evidence

- Average remediation time per high-risk gap

- Assurance level uplift (limited → reasonable)

- Cost per reporting cycle

- Investor Q&A resolution time with cited answers

Why Databricks Is the Foundation:

The Agent’s credibility depends on governed data, reproducible logic, and scalable AI. Databricks provides all three:

- Databricks Lakehouse unification: Bring ESG, finance, supply chain, HR, and audit data—structured and unstructured—into one platform for consistent analysis.

- Delta Lake for integrity on Databricks: ACID transactions, time travel, and versioning create auditable trails for every number and narrative.

- Unity Catalog for Databricks governance: Centralized permissions, lineage, and data classification ensure least-privilege access and compliance with privacy rules.

- MLflow for model governance: Track experiments, register models, capture inputs/outputs, and record who approved what, critical for AI assurance.

- Scalable AI/LLM serving on Databricks: Run document intelligence and benchmarking at enterprise scale, with secure inference and monitoring.

- Collaborative workflows via Databricks Notebooks: Notebooks, Jobs, and Delta Live Tables orchestrate repeatable pipelines; Finance, Legal, ESG, and Audit teams work from a single source of truth.

Net result: a verifiable, explainable, and defensible compliance engine built entirely on Databricks, satisfying auditors and regulators while empowering business users.

Implementation Path: Start Small, Scale Fast

- 90-Day Pilot: Choose 2–3 high-material topics (e.g., Scope 3, water, DEI). Connect source systems, ingest last year’s disclosures, and run the first gap analysis.

- Embed Workflows: Integrate recommendations with ticketing/approval flows; enable executive scorecards.

- Expand Coverage. Add additional frameworks, geographies, and evidence types.

- Assurance Ready: Provide auditors with clause-level evidence packs and lineage; shorten assurance cycles.

- Continuous Compliance: Keep the Agent running year-round so reporting becomes a by-product of good controls, not a yearly scramble.

Security, Privacy, and Trust by Design:

- Data minimization & masking for sensitive fields.

- Fine-grained access controls via Unity Catalog.

- Lineage & change logs for any metric or narrative edit.

- Human-in-the-loop reviews for high-impact statements.

- Explainable outputs: each claim links to the clause, data source, and transformation steps.

This is how you move from “AI says so” to “AI says so, and here’s exactly why.”

The Road Ahead: Responsible AI at the Core

Compliance is shifting from static, annual reporting to continuous, decision-useful assurance. The winners will:

- Treat ESG data like financial data—governed, reconciled, and auditable.

- Use AI to predict emerging risks and prescribe corrective actions.

- Communicate with investors using evidence-based narratives that stand up to scrutiny.

- Align compliance work with operational improvements—turning reporting into real performance gains.

The AI Compliance Agent, powered by Databricks, is your path to that future: a system that is always current, always explainable, always credible.

Closing: Turn Compliance into a Credibility Engine

In a world where trust is currency, compliance is the mint. The AI Compliance Agent transforms ESG reporting from laborious and reactive to efficient, proactive, and trustworthy. Built on Databricks, it unifies data, governs access, explains logic, and scales intelligence, so your disclosures are accurate, aligned, and audit-ready.

Stop chasing the treadmill. Build a runway.

Verify, Trust, Comply. That’s the future of responsible AI on Databricks. where compliance isn’t just met; it’s mastered and made strategic.