Finance isn’t just about reporting numbers anymore—it’s about shaping strategy, guiding capital allocation, and building resilience in a volatile world. CFOs and their teams sit at the centre of growth, profitability, and liquidity decisions, yet too often they are constrained by fragmented systems, static dashboards, and manual spreadsheets.

In fast-moving markets, these limitations can be fatal. When forecasts are built on outdated assumptions, when liquidity blind spots are missed, when cross-functional alignment breaks down—organisations stumble. Finance leaders need a smarter way to plan, predict, and act.

Enter FinQ.

FinQ is a multi-agent, multi-Genie space AI solution designed specifically for Financial Planning & Analysis (FP&A). Built with finance-domain intelligence, it unifies fragmented budgets, forecasts, sales data, cost structures, and customer behaviour into a single trusted environment. By reasoning across financial and operational data, FinQ transforms raw numbers into actionable narratives that empower CFOs to optimise capital allocation, strengthen liquidity, and drive sustainable growth.

Unlike traditional BI dashboards or SQL-based reporting tools, FinQ delivers predictive, prescriptive insights. It helps finance teams model “what if” scenarios, monitor CFO-critical KPIs in real time, and collaborate seamlessly with sales, supply chain, and operations. With FinQ, finance shifts from explaining the past to shaping the future—with agility, precision, and confidence.

The CFO’s Dilemma: Finance at a Crossroads

Modern CFOs face a unique set of challenges:

- Fragmented Data: Budgets in ERP, forecasts in spreadsheets, sales in CRM, costs in BI dashboards. Integrating these sources is a nightmare.

- Limited Insights: Dashboards report the “what” but not the “why” or “what next.”

- Static Reporting: Finance spends more time reporting history than modelling the future.

- Collaboration Gaps: Finance, sales, supply chain, and operations rarely work from the same source of truth.

- Slow Decision Cycles: Manual planning, reconciliation, and scenario modelling slow down agility.

The result? Finance leaders react to market shifts instead of anticipating them.

The Solution: FinQ

FinQ transforms FP&A with a finance-native AI platform built on Databricks. Its multi-agent architecture allows specialised AI agents to reason across budgets, forecasts, sales trends, and operational data. Genie Spaces provide secure, collaborative environments where finance, sales, and operations can align strategies.

Key value proposition:

- Finance teams spend less time wrangling spreadsheets.

- CFOs get forward-looking insights they can trust.

- Businesses make faster, smarter, and more aligned decisions.

Key Features of FinQ

Unified Forecasting

- Integrates SAP, MDR, Salesforce, ERP, and BI data.

- Produces context-aware forecasts that adapt to market shifts.

- Example: A retailer merges ERP cost data with Salesforce pipeline data for accurate revenue forecasting.

Context-Aware Insights

- Interprets business questions, not just SQL queries.

- Aligns recommendations with CFO goals—profitability, liquidity, capital allocation.

- Example: Instead of “show revenue by region,” ask “Which regions can offset a 15% shortfall in Europe?”

KPI-Centric Monitoring

Tracks CFO-critical KPIs in real time:

- Revenue Growth

- Gross Profit Margin

- EBITDA & Operating Margin

- Net Profit Margin

- Cash Conversion Cycle (CCC)

- Free Cash Flow (FCF)

- Return on Invested Capital (ROIC)

- Debt-to-Equity Ratio

- Earnings per Share (EPS)

Self-Service Analytics

- Finance and non-finance users can model scenarios without technical barriers.

- Encourages collaboration across finance, sales, supply chain, and operations.

- Example: Supply chain leader models the impact of raw material cost increases directly in FinQ.

Governed & Secure

- Powered by Databricks Unity Catalogue for secure, role-based access.

- Ensures compliance and audit readiness across geographies.

- Every calculation, metric, and recommendation is traceable and auditable.

What You Can Ask FinQ

FinQ isn’t about “queries”—it’s about conversations with finance intelligence.

Examples:

- “What happens to EBITDA if pipeline conversion drops by 10%?”

- “When will we face a cash flow shortfall, and what can prevent it?”

- “Which cost centres consistently overshoot budgets and erode margin?”

- “How will a 5% increase in raw material costs affect Gross Profit?”

- “What’s the impact of changing DSO on our Cash Conversion Cycle?”

These prescriptive, forward-looking insights empower CFOs to act proactively, not reactively.

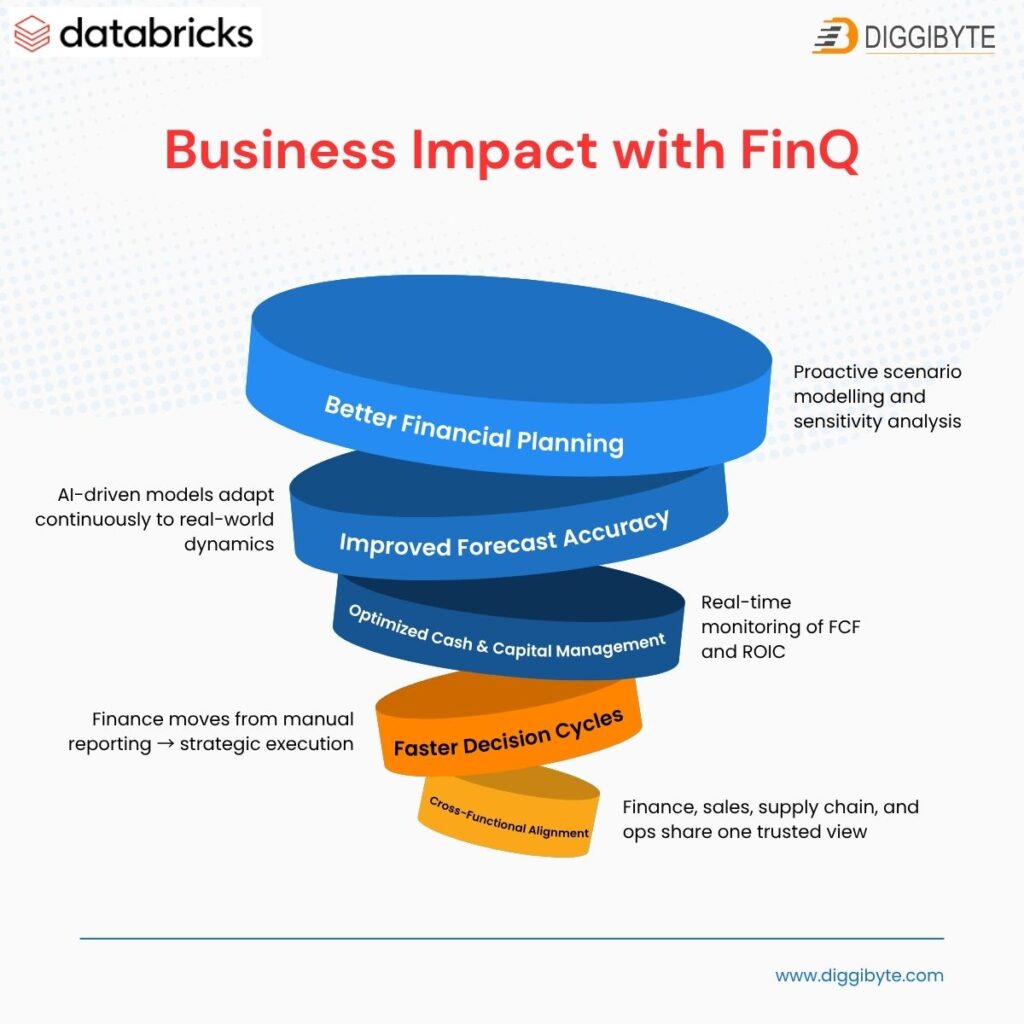

Business Impact with FinQ

- Better Financial Planning: Proactive scenario modelling and sensitivity analysis.

- Improved Forecast Accuracy: AI-driven models adapt continuously to real-world dynamics.

- Optimised Cash & Capital Management: Real-time monitoring of FCF and ROIC.

- Faster Decision Cycles: Finance moves from manual reporting → strategic execution.

- Cross-Functional Alignment: Finance, sales, supply chain, and ops share one trusted view.

Example: A global manufacturer used FinQ to simulate raw material cost increases across the supply chain, instantly quantifying EBITDA impact and adjusting sourcing strategies—something that would normally take weeks.

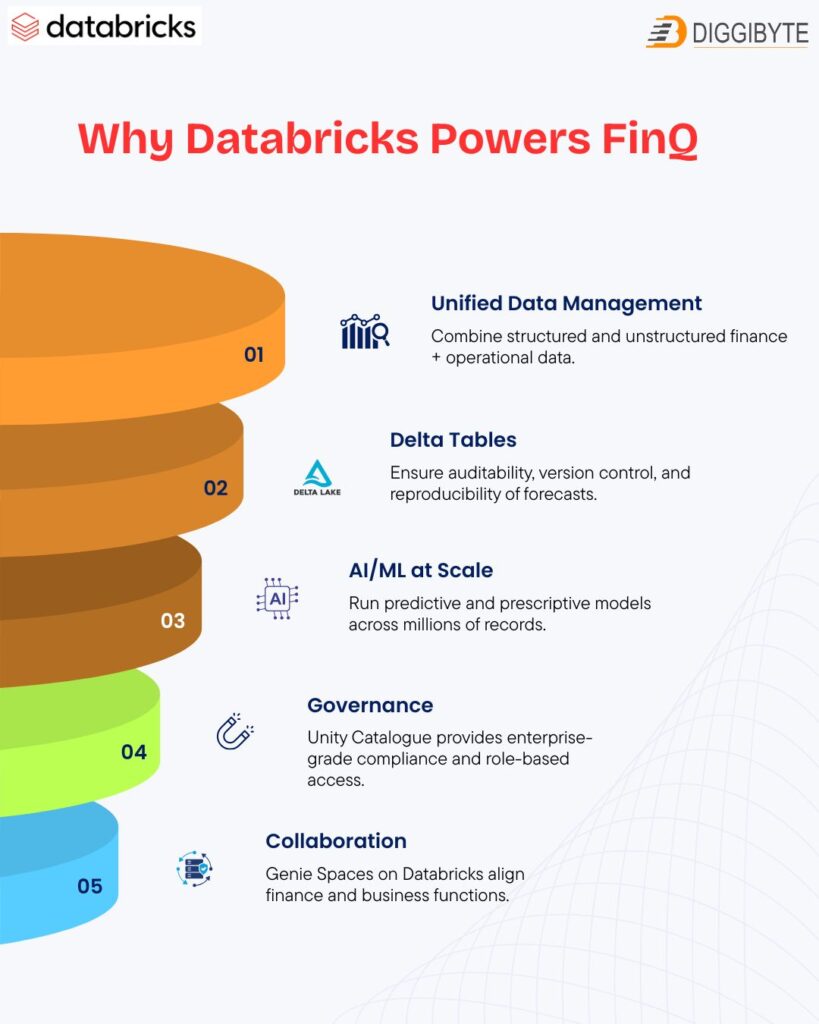

Why Databricks Powers FinQ

FinQ’s intelligence is possible only because of the Databricks Data Intelligence Platform:

- Unified Data Management: Combine structured and unstructured finance + operational data.

- Delta Tables: Ensure auditability, version control, and reproducibility of forecasts.

- AI/ML at Scale: Run predictive and prescriptive models across millions of records.

- Governance: Unity Catalogue provides enterprise-grade compliance and role-based access.

- Collaboration: Genie Spaces on Databricks aligns finance and business functions.

With Databricks, FinQ is not just another dashboard—it’s a trusted intelligence platform for CFOs.

Future Vision: Finance as a Strategic Copilot

The future of FP&A is not about reporting—it’s about co-piloting business strategy.

We envision:

- CFOs working with AI copilots for capital allocation decisions.

- Finance leaders are running real-time scenario planning during board meetings.

- Cross-functional teams collaborating in Genie Spaces with governed, shared insights.

- Finance is shifting from scorekeeping to strategy-shaping.

With FinQ, powered by Databricks, this future is here today.

Real-World Use Cases of FinQ

The true power of FinQ lies in how it adapts to industry-specific challenges. In retail, CFOs can forecast seasonal demand swings, integrate supply chain costs, and identify profitable regions—all from one platform. In manufacturing, leaders can model the financial impact of fluctuating raw material costs, shifting trade policies, or production bottlenecks in real time. For banking and financial services, FinQ helps manage credit risk, monitor capital adequacy ratios, and optimize liquidity under evolving regulatory requirements. Meanwhile, in healthcare, CFOs can track reimbursements, align operating costs with patient demand, and ensure compliance across jurisdictions. These examples illustrate how FinQ transforms static financial reporting into an intelligent decision-support system across sectors.

Strategic Benefits for CFOs

Beyond technology, FinQ changes the role of finance itself. It allows CFOs to reposition as strategic copilots to CEOs and boards, guiding business direction with forward-looking insights. By integrating financial and operational data, leaders gain a 360° view of performance, bridging gaps between what happens on the ground and how it translates into financial health. The ability to simulate scenarios instantly reduces risk exposure and builds confidence in capital allocation, M&A decisions, or expansion into new markets. Instead of reacting to quarterly results, finance can lead conversations on how to sustain profitability and growth over the years.

The Road Ahead: Autonomous Finance

Looking forward, FinQ sets the foundation for autonomous finance—where intelligent systems can detect anomalies, recommend corrective actions, and even automate parts of financial planning. Imagine AI copilots that flag liquidity risks before they occur, suggest optimal hedging strategies, or benchmark company KPIs against global competitors in real time. As data volumes expand and volatility increases, finance leaders who embrace such platforms will not just survive disruption—they will shape it.

Closing Thoughts

Finance is no longer about explaining what happened—it’s about shaping what happens next.

FinQ transforms fragmented financial data into narratives that guide growth, liquidity, and resilience. With predictive insights, CFO-critical KPIs, and prescriptive recommendations, it empowers finance leaders to act with speed and confidence.

Built on the Databricks Data Intelligence Platform, FinQ provides the scale, governance, and security enterprises need to trust AI-driven finance. By unifying data, enabling cross-functional collaboration, and delivering actionable recommendations, FinQ makes finance a true driver of competitive advantage.

Turn numbers into narratives. Turn data into decisions. That’s FinQ in action.